The world is changing rapidly and so are investors’ priorities.1

Global awareness of sustainability has never been higher. Investors as well as consumers, corporations and policymakers are shifting their focus toward addressing environmental, social and governance (ESG) issues.2

We believe sustainability matters for all investors

At UBS, we believe sustainability is relevant to how you manage your wealth. Sustainable investing can help you advance your financial goals while contributing to sustainability outcomes. We invite you to discover the world of sustainable investing and the possibilities it offers you to pursue what matters most.

Sustainability is central to our

purpose, so it’s only natural that we’re

putting sustainable investing where it

belongs: at the heart of what we do. It

is our preferred solution for wealth

management clients wishing to invest

globally.3

Defining the E, S & G

ESG topics can present new opportunities

as well as important considerations for

any investment. However, these topics

drive the strategy when it comes to

sustainable investments.4

Environmental

Includes water and waste management; ways of improving energy efficiency; carbon intensity and climate risk management.

Social

Such as data privacy and security; managing supply chains effectively; diversity and equality; human capital management.

Governance

Such as addressing issues of board diversity and corporate transparency.

Will she always be this happy?

Live a good life on a healthy planet?

Can sustainable investing protect her future?

What is sustainable investing?

What is sustainable investing?

Sustainable investing is not an investment product, or an asset class. It’s an investment philosophy. Sustainable investing offers the potential to create better outcomes—for your portfolio and our future.

Two fundamental approaches2

Two fundamental approaches2

At UBS, we see two main approaches to sustainable investing:*

Sustainability focus-Investing in strategies with a clear sustainability objective

Example: Intentionally investing in

companies that manage a range of ESG

issues and opportunities better than

their competitors

Impact investing-Investing in strategies that seek to generate measurable, verifiable and positive environmental or social outcomes

Example: Investing in companies with the

objective to engage in dialogue with

management to drive progress on social

or environmental outcomes

*Please review

Important information about

sustainable investments

in the disclosures at the end of this

document.

Myth vs. reality

Myth vs. reality

Myth

You give up returns with sustainable investments

Myth

You can’t measure the impact of a sustainable investment

Myth

Sustainable investing is only about protecting the environment

What we offer

What we offer

- Sustainable and thematic exchange traded funds, mutual funds and separately managed accounts

- Tailored private investment opportunities

- Differentiated intellectual capital and investment framework from our Chief Investment Office

Approach sustainable investing your

way

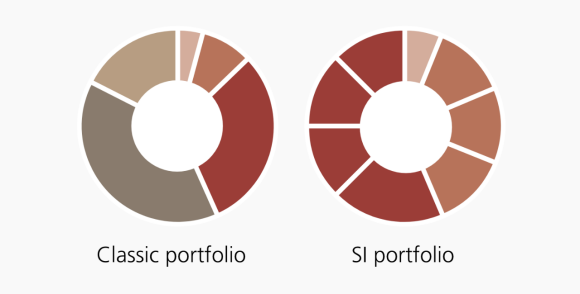

Approach sustainable investing your way

Once you determine your approach, there are a few different ways you can incorporate sustainable investing into your portfolio.

Insights

Take a closer look at sustainable

investing—and discover the difference

it could make for your portfolio—and

the world

Take a closer look at sustainable investing—and discover the difference it could make for your portfolio—and the world

Key findings

Key findings

59%

59%

of investors surveyed are more interested in sustainable investing as a result of COVID-19 5

69%

69%

of women surveyed are highly interested in sustainable investing as a result of COVID-19 5

76%

76%

of younger investors surveyed are highly interested in sustainable investing as a result of COVID-19 5

Research

Research